RiskMine has been launched by Titan, Supercharging AI-driven Credit Risk Management

Read More

AI-powered Credit Risk Management

Lenders get more done with RiskMine

Transform your credit management into real-time insights with AI-powered Credit Risk Management.

Become an early customer

Eager to get your hands on RiskMine? We're launching General Availability soon. Join our waitlist to be the first to know!

Secure, Fast, Streamlined

Request

Connect existing customer documents, CDD information, and credit bureau reports to initiate the credit review process.

Upload

Apply your firm's lending and credit policies to set parameters for AI-powered analysis.

Review

Pre-validate credit applications at scale with AI, improving quality based on configured credit policies.

Approve

Once credit reports and AI recommendations are reviewed, make final credit decisions, and generate customized offer terms.

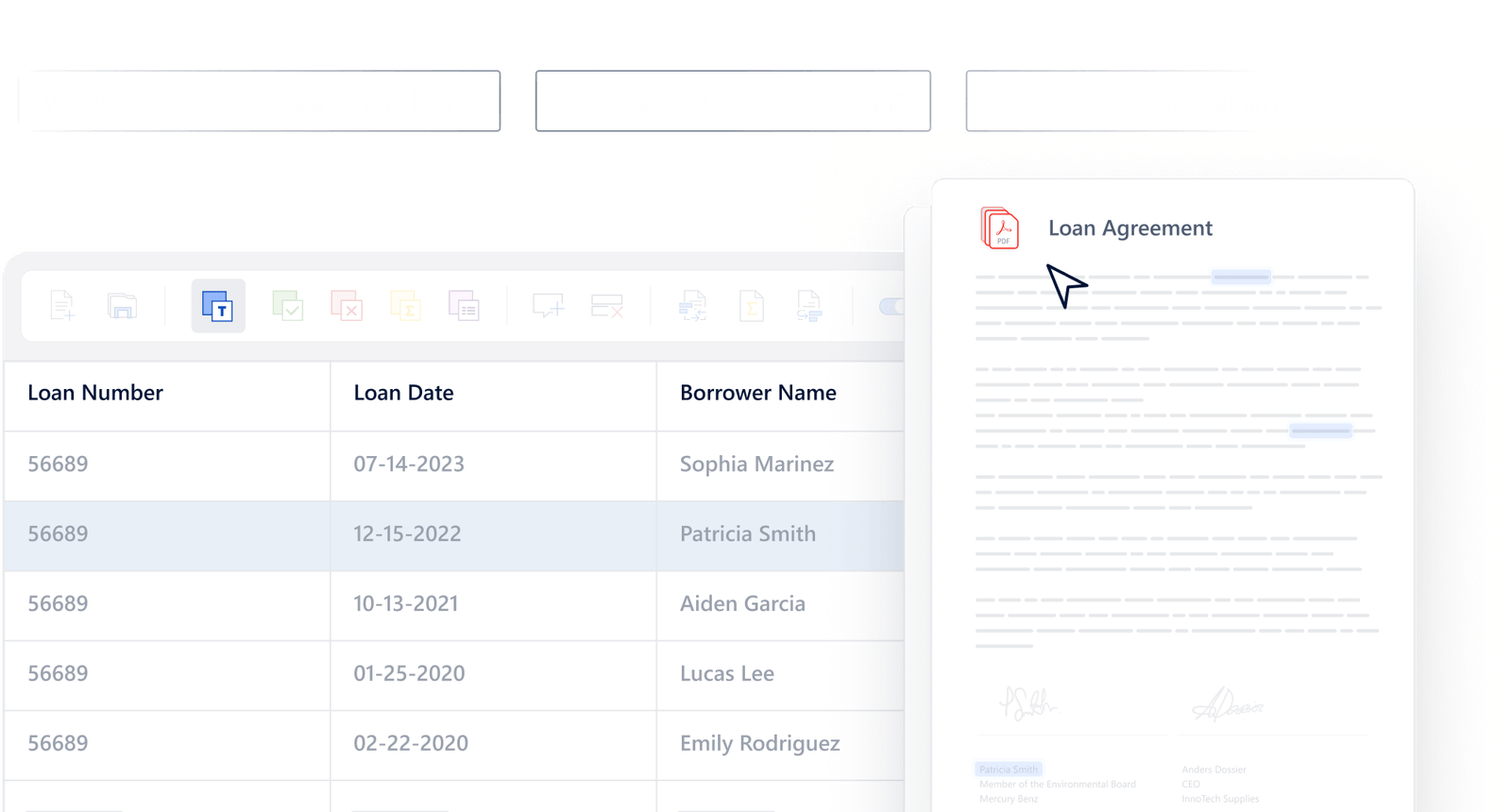

Process credit applications at scale

Pre-validate financial documents at scale with AI, improving decision quality. RiskMine provides credit risk assessments within seconds, saving hours or days of manual underwriting work.

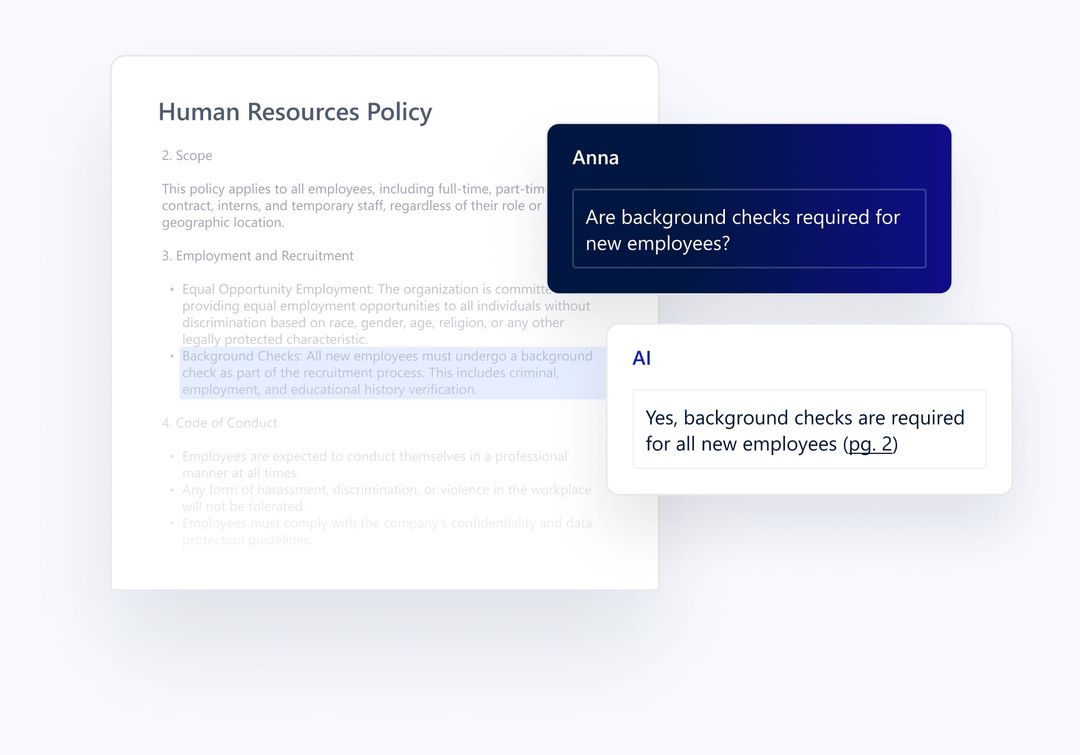

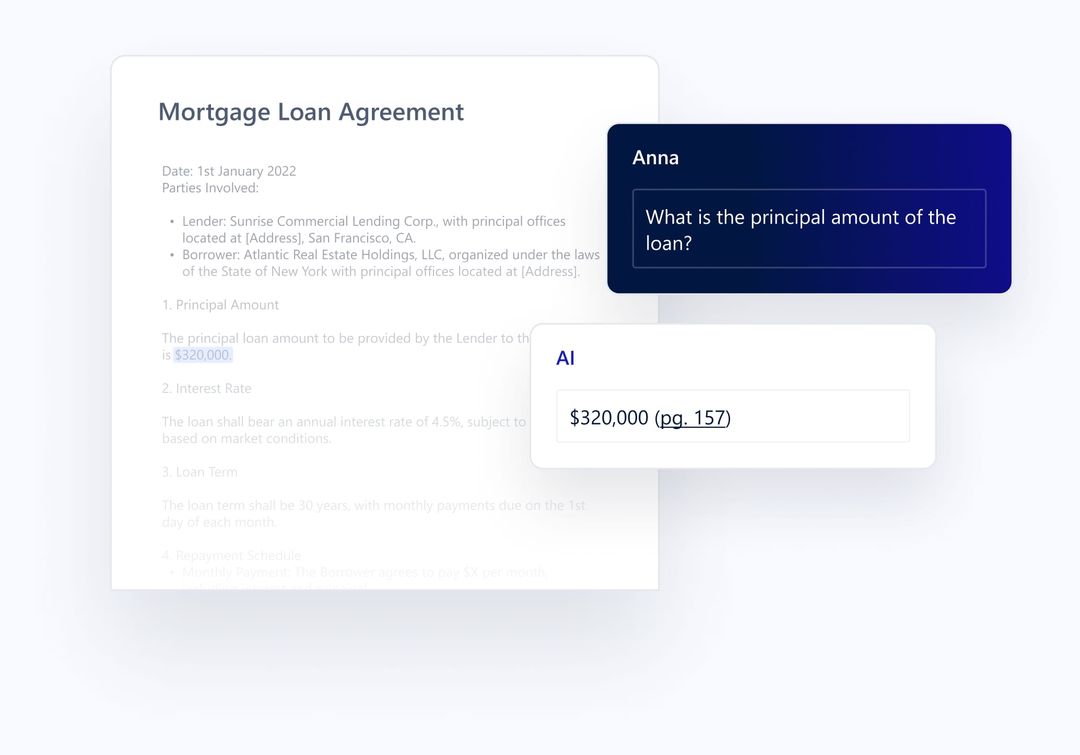

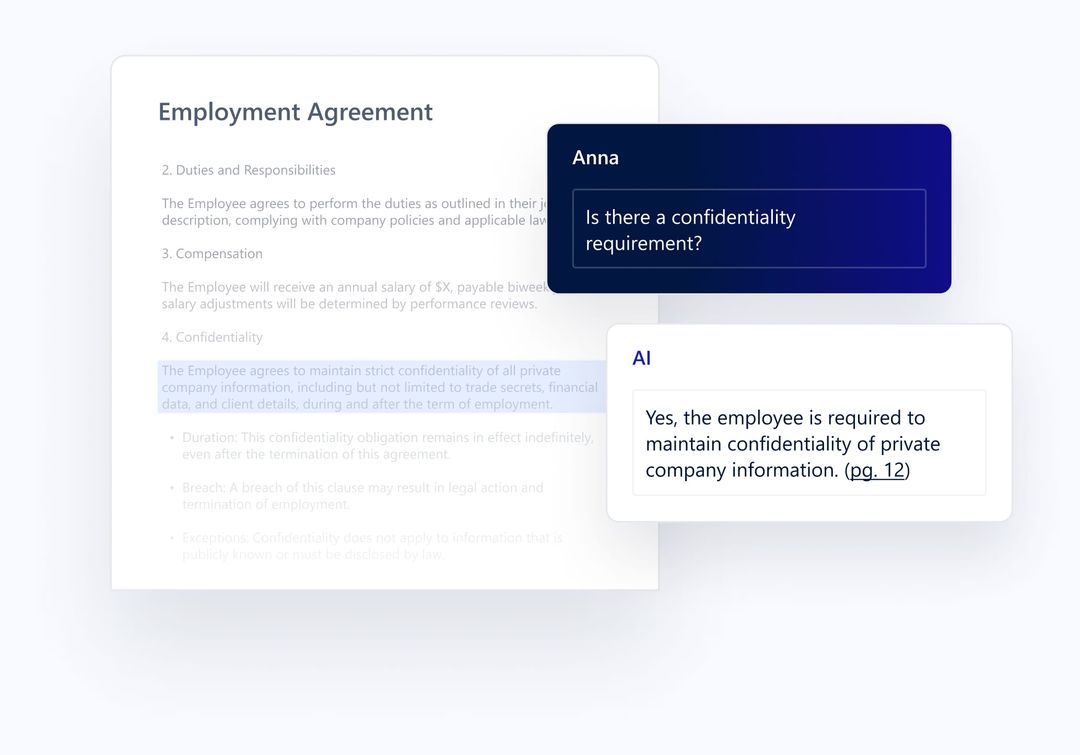

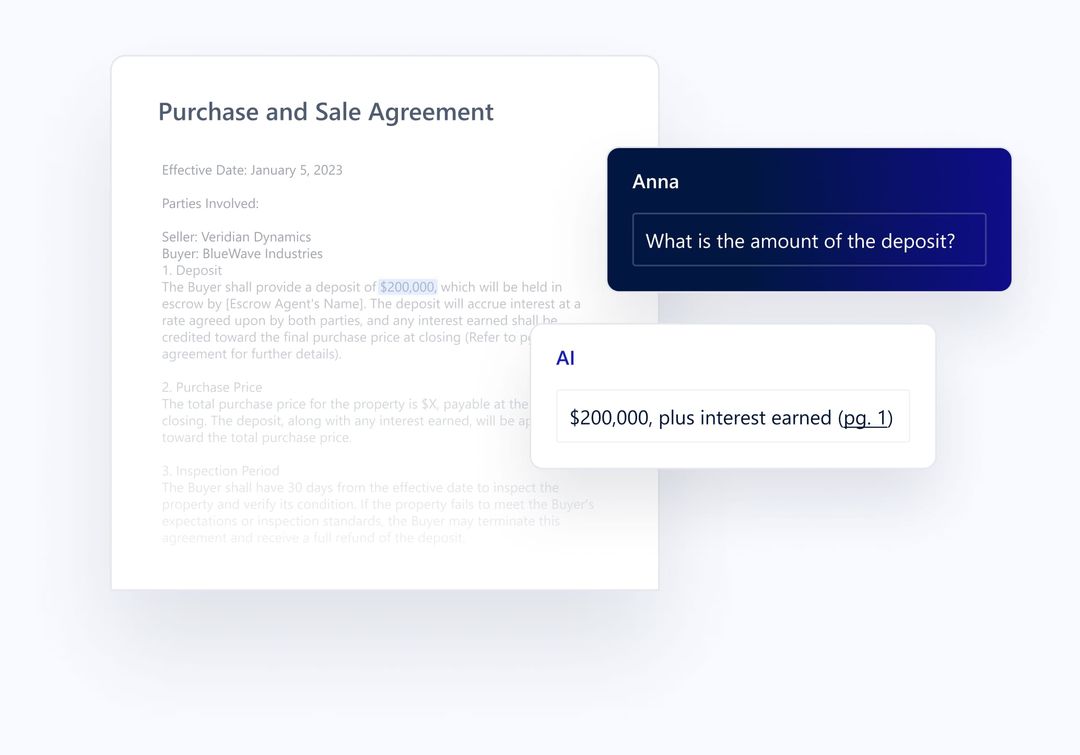

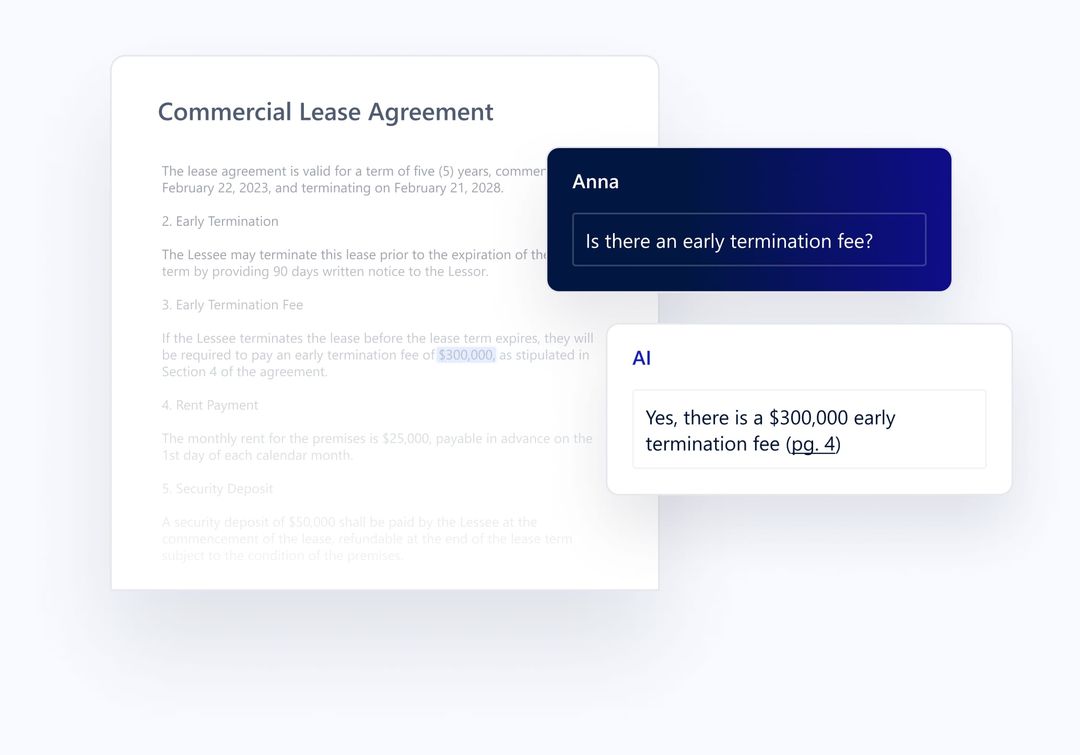

Analyze lengthy

documents in seconds

Query financial indicators

Receive insights with references to source documents

Review AI-generated risk profiles and recommendations

Adjust credit decisions based on policy guidelines

Export ready-to-approve credit packages

Instant sync with Titan Platform

Enhance end-to-end workflows by automatically importing approved credit decisions into the Titan CRM Platform.

“By leveraging RiskMine's AI capabilities, we've streamlined our credit decisioning process through automated financial data extraction, risk assessment, and policy compliance validation.”

Rick Mehan

Credit Risk Leader

Industry leading security

SOC 2 Certified

RiskMine security practices and controls have been independently audited by experts.

Encryption

Data is encrypted in transit and at rest using the most secure algorithms available.

Zero Data Retention

Your data is never used to train AI models and is deleted permanently once you remove it.

Ready to enhance your credit decisioning process with AI?

Learn how AI can improve your efficiency, productivity, and transform credit decisions into real-time insights.